Mortgage resources, tools and advice

Online mortgage calculators

Our handy mortgage calculators help you evaluate your finances and determine what your next steps should be in your home buying journey.

Repayments calculator

Calculate how much your monthly mortgage repayments might be based on the amount you expect to borrow.

Switching calculator

We work with all major lenders. Simply add your details into our calculator to see how much you could save each month.

Overpayment calculator

Concerned you might be paying too much now, or into the future? Let’s crunch some numbers and see what you’re able to save.

Additional doddl services

Home buyer helper

Everything you need to start your journey. Free and exclusive to doddl mortgage approved clients.

Flat fee legal services partnership exclusive to doddl clients.

Employee status certificate download your 3 year status certificate

The Ultimate Mortgage Checklist

For anyone starting off on their mortgage journey. Understand the requirements for getting a mortgage in Ireland.

Frequently asked questions

Our expert mortgage brokers are always on hand to answer any qustions you might have.

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Who are doddl?

We offer more than just mortgage, we offer home insurance, life assurance, we have a home buying helper expert within our team to guide you through the home buying process and we offer a digital conveyancing legal partner to help you complete out on your purchase or switch.

We are a mortgage broker working with all major lenders and insurance providers in Ireland and are regulated by the Central Bank of Ireland.

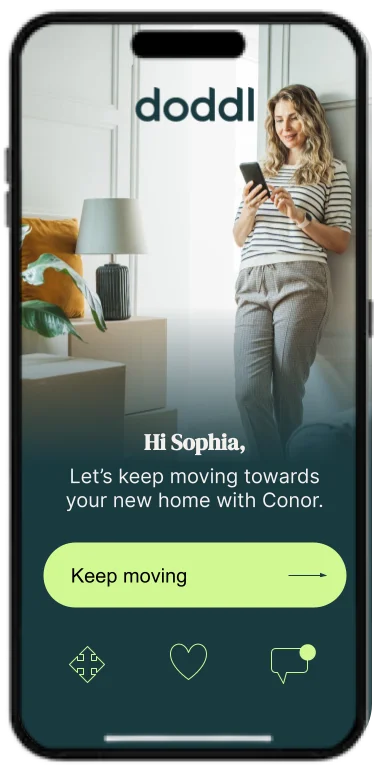

We are a digital broker offering mortgage consultations at a time that suits you. We have a secure application portal, our Digital Mortgage Experience DMx Platform which is unique in the Irish market and available to doddl mortgage clients only. This platform allows you access to your mortgage account 24/7, provides full transparency as to your stage in the process all supported by your dedicated mortgage advisor who you can call or message through the portal.

We work on behalf of our clients to secure the best mortgage and terms for their individual circumstances and we are your mortgage partner throughout your entire mortgage lifecycle. We will advise you when you can save money by switching to a better rate and are always on hand to answer any queries you may have.

Read more about us here.

Do doddl lend money?

No doddl is not a bank or money lender. doddl is a mortgage and insurance broker working with Irelands largest providers including lenders who do not deal with clients directly, who only work with select brokers such as doddl.

Which banks do doddl work with?

We work with all major Irish lenders. Bank of Ireland, Avant Money, AIB (through Haven their broker channel), Permanent TSB, Finance Ireland and ICS. So, there’s no need for you to apply to each lender separately, we can do all the research and make applications to your chosen lender with you.

We will apply to lenders on your behalf. When you come to doddl you have access to all major lenders, cashback offers, lowest market rates. Our role is to find the mortgage product that best suits your needs.

How does doddl make money?

Our service is free to you, our customer, we get paid by the lender that you choose to take your mortgage with.

We get paid the same fee regardless of the lender or product you select, which ensures there’s no lender or product bias. Also, you’ll get the same rates via doddl, as you would by going to the lender directly. Our role is to help you identify the best mortgage for you and to do the hard work on your behalf in securing approval and dealing with the bank.

You will never be charged anything by doddl.

How does doddl use my data?

We only use the data for the purpose that it was collected for and carefully protect your data from loss, misuse, unauthorised access or disclosure, alteration or destruction.

This is explained in our Privacy Policy.

Mortgage insights, tips and news

Buying a Home in Ireland? You need to know these 10 statistics

Key statistics on home buying in Ireland for 2026, brought to you by our mortgage experts

LATEST: Doddl Mortgage Switching Index 2026 – A must read

The latest Irish Independent doddl.ie Mortgage Switching Index shows that while switching drawdowns have reached their second highest level since 2008, activity remains far below where it should be.

3 Ways to boost your chances of becoming a home owner in 2026

Three ways to boost your chances of becoming a homeowner in 2026

Doddl in the News – Your Mortgage Updates for 2026!

Looking for Mortgage Updates for 2026? 🗞️Doddl in the News x5 this week! We are the experts the media call upon. We...

Your Guide to Mortgages and Home buying in 2026

The Irish mortgage market is constantly changing. Over the last twelve months we have seen rate cuts, new products...

Got a Mortgage? The 1 thing that could save you thousands

What is the one thing that most people don’t review yet is likely to be their largest financial commitment? Their...

Sole Home Buyers – who’s buying what?

Some Sole Home Buyer Statistics Mortgage Draw downs Sole First Time Buyers (FTB’s) account for 31% of FTB mortgage...

Top 10 Housing & Mortgage Market facts

The Q3 MyHome data provides evidence that house price inflation is slowing down. The market remains very difficult however with the pace of price rises merely softening.

Applying for a Mortgage? Here’s what you need to know

Everything you need to know about how a bank will assess your mortgage application.

We’re the mortgage experts the media call on!

The latest, to your letterbox

Subscribe to our newsletter to stay up to date with mortgage tips, customer stories, and so much more!