The full mortgage process, simplified

We’ve helped thousands of clients find and secure the best mortgage for them. We know what to expect, and what comes next… so we baked that into our Digital Mortgage Experience (DMx) to make your life a whole lot easier.

DMx features & benefits

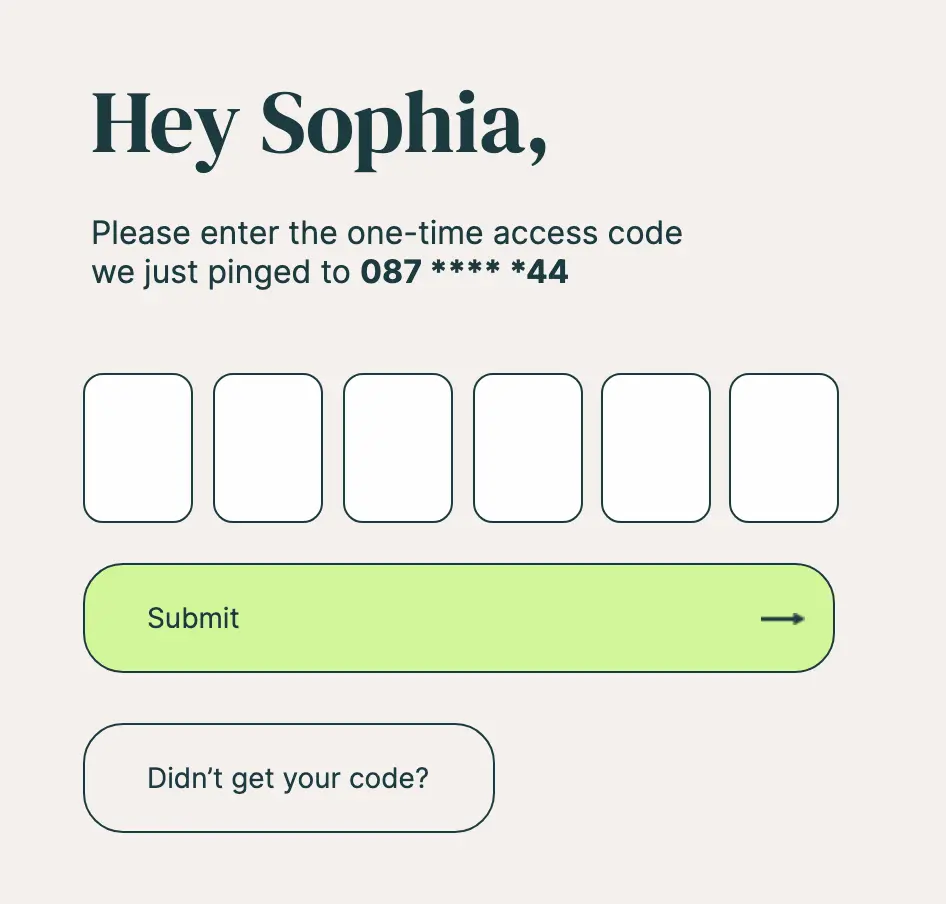

Secure, reliable, fast

We take privacy seriously. Your personalised online mortgage tool is fully secure, and uses 2-factor authentication to keep everything safe and snug.

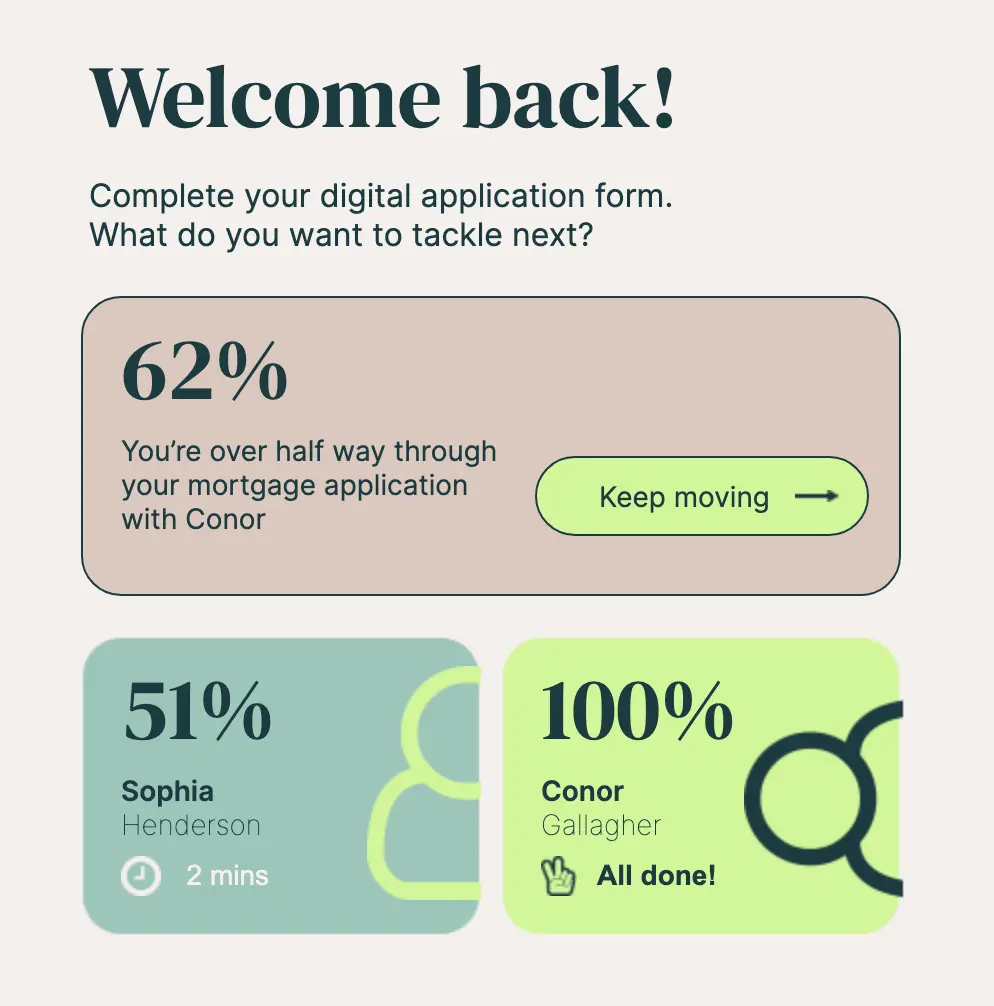

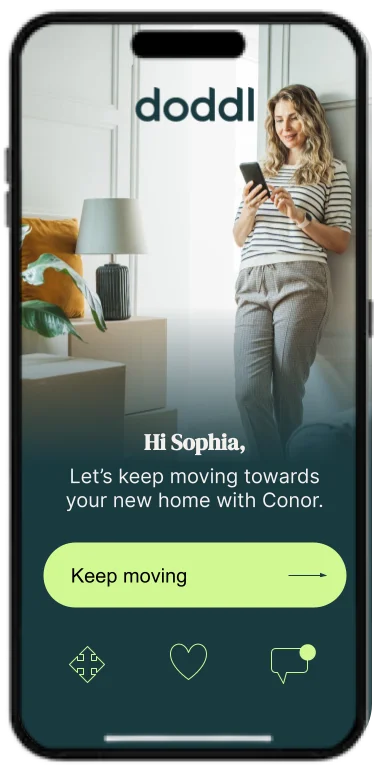

Designed around you

When you choose to get started with doddl, we’re already clear on who you are, what you want, and what your options are. So, even at first login, everything is focused on only the specific things we’ll need to get you through the mortgage application process.

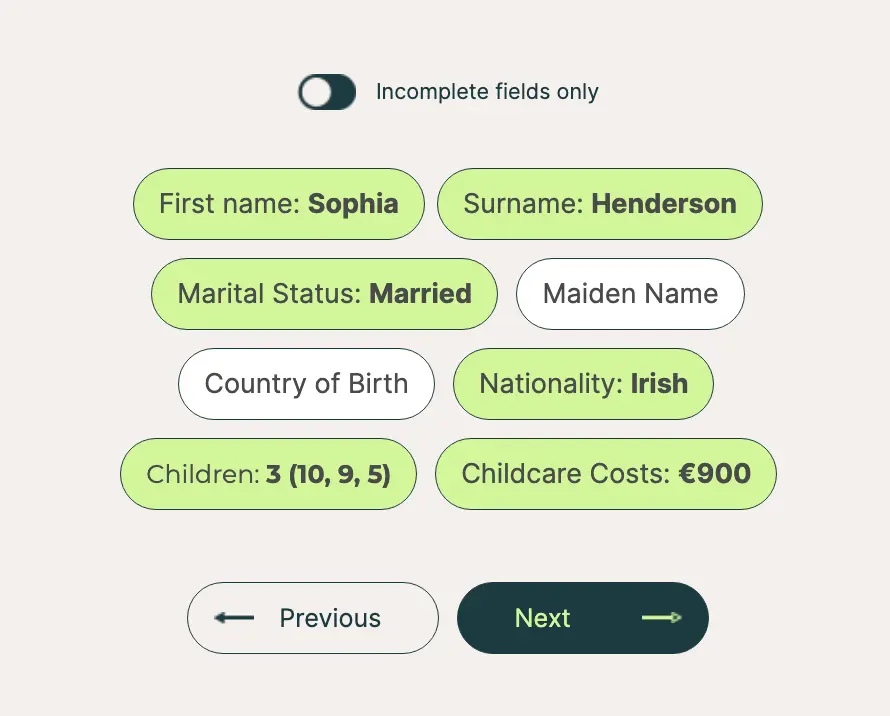

Who loves forms anyway?

The 1980’s, that’s who! We’ve scrapped all that. With doddl, you can clearly see what’s done, and what’s left to do.

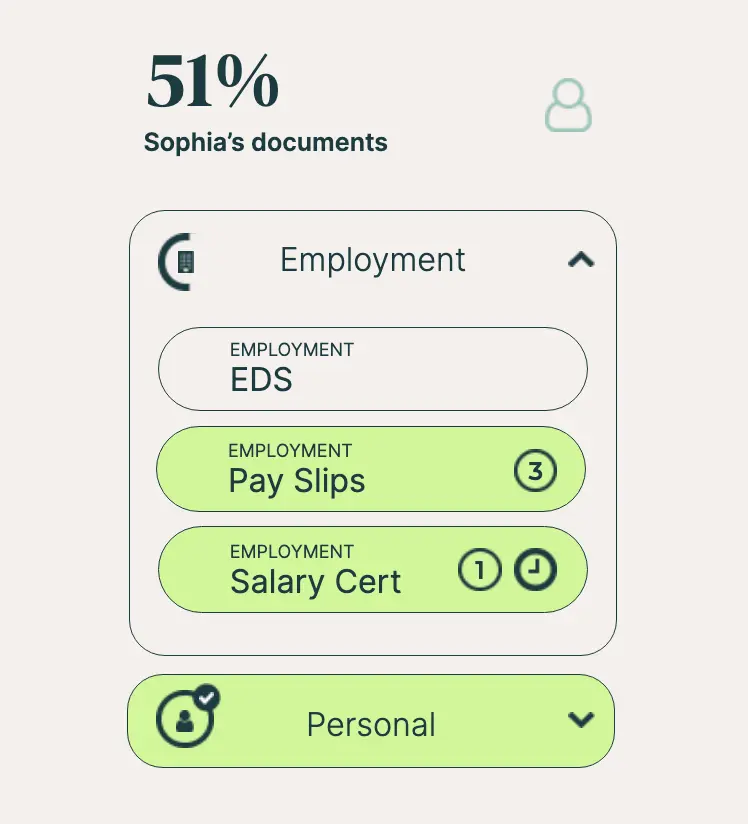

Documents, doddl'd

Effortlessly upload the documents your specific lender is going to need, and have your dedicated advisor check everything is in order.

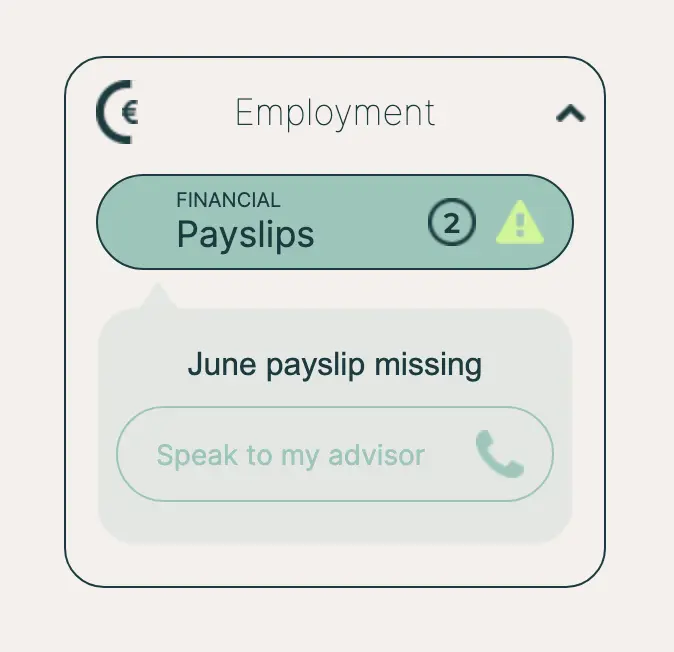

With mortgage AI supports throughout

More than that, our portal automatically let’s you know if you’re missing that pesky June payslip, so you’ve got a clear list of what’s left to gather.

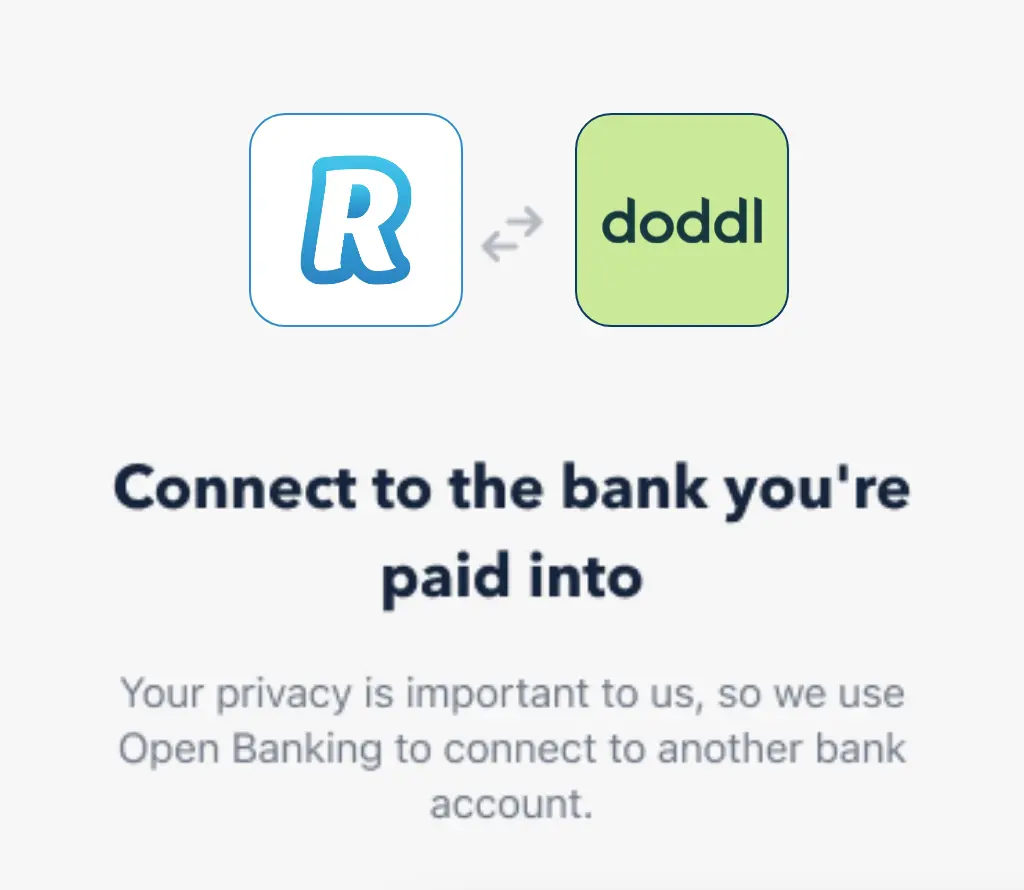

Open Banking

Choose to leverage Open Banking and effortlessly hook up all your accounts. No more chasing January’s credit card statement from your lender.

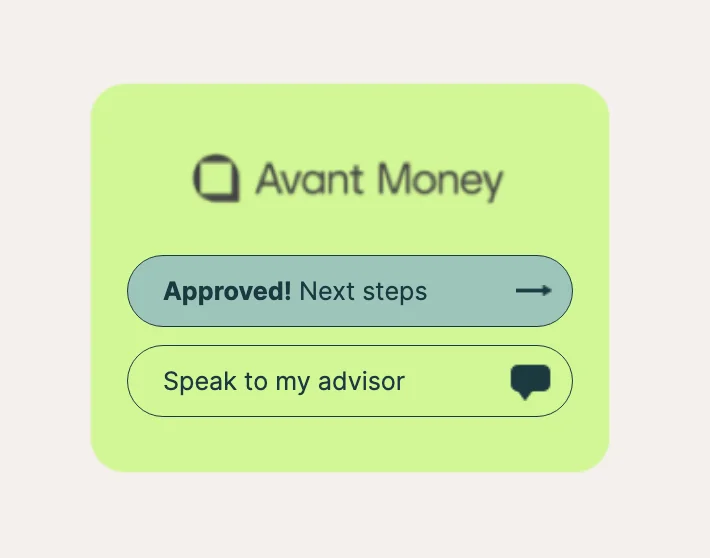

One point of contact, all major Irish lenders

Once your application is in, your advisor will help you choose the right lender and mortgage for you before checking everything and sending your case for approval.

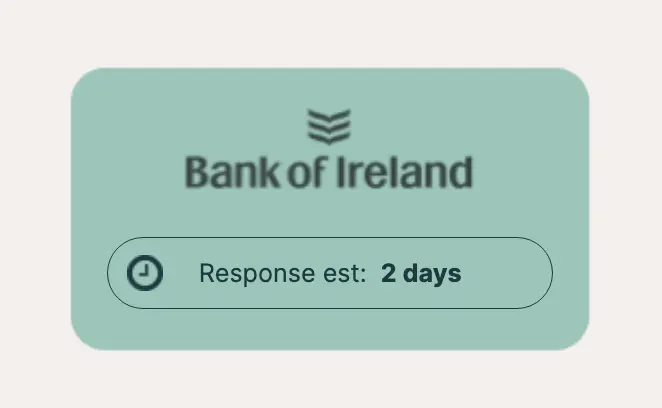

Track everything online

We’ll let you know when your chosen lender has approved your mortgage (typically 5 days with doddl), and if there are any conditional information required.

All the way to draw down

When you’ve found the home for you, we’ll go get your letter of offer and guide you through the final steps to happy home ownership.

DMx frequently asked questions

Still not ready for us to make your mortgage journey a doddl, at no cost to you? Read our Frequently Asked Questions to find out more.

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

What is the doddl DMx platform?

At doddl we have been working with mortgage applicants for over a decade. We realise that mortgages are complex and clunky.

We listened to our customers who were very clear that their priorities during the mortgage application process were to be able to get expert advice, have a dedicated advisor, access to all the best rates and products on the market and to be able to easily understand what option best suited them. They wanted to be able to complete and sign a digital application form, to be able to upload documents securely and most importantly have a transparent view of where they are in the process 24/7.

We listened! And we created what we believe is a best in class Digital Mortgage Experience, our DMx platform.

You will have 24/7 access to your mortgage account, you will know exactly where you are in the process, you will be able to message and call your advisor with any queries and our portal will also provide you with access to quotes and content re life cover, home insurance and a digital conveyancing platform.

You will also have access to our free Home Buying Helper service via your account on our DMx portal once you are mortgage approved.

This is a unique platform available exclusively to doddl mortgage applicants. We believe it will make your mortgage and homebuying journey a better experience.

How do I get started?

It’s easy to get started. Whether purchasing or switching, just head on over to our Get started page and walk through a few simple steps.

Once you complete these steps you will be given a link to access you account on our portal. This will then set out all documents required to complete a mortgage application, you will be advised of the doddl advisor who has been assigned to support you through the process and you can start to work through your mortgage application on our secure application plaform, our Digital Mortgage Experience portal or DMx.

You will have access to your account 24/7, you can message or call your advisor, you can see what stage you are in the process and whats next, all transparent and all with the help and support of our team.

What happens if I choose to progress?

We’ll let you know which documents we’ll need. We’ll also send you a link to our secure customer portal - the doddl DMx.

This allows you to upload documents and complete your mortgage application easily online. You’ll always have access to your account and will have visibility of your application at every stage. Your dedicated advisor will guide you through as your application progresses and be there to answer any questions you have.

Why choose doddl?

We’ll not only act as your mortgage partner but we’ll be there to provide friendly, impartial advice to ensure you glide through the process.

We’re here to answer any queries you have and will review rates at regular intervals to ensure you never pay more than you need to - all in one simple to navigate Digital Mortgage Experience.

We understand that most people have never done this before, but we’ll be there for you, every step of the way, acting in your best interests at all times.

Happy homebuyers across Ireland

4.8 out of 5 Google Rating

We’ve helped thousands of Irish customers sort their mortgages, without all the hassle.

We had a brilliant experience with doddl and would highly recommend their service to anyone seeking a mortgage in today’s market.

We first contacted doddl in early March 2023, and have now closed our sale and received the keys to our home by mid June 2023. We couldn’t have asked for better. Thank you to the entire doddl team!

doddl were amazing to deal with & I recommend their service to everyone. I found the Doddl dashboard easy to use and great to track / refer back to uploaded documents. Celly, Catherine, Elaine & Caitriona’s wealth of knowledge is exceptional.

Their helpfulness, professionalism and efficiency is first class. Only for Elaine in Completions, I would not have met the deadline for the lower rate. Thank you!

doddl were an absolute pleasure to deal with from start to finish. Our Fixed Term was due to expire next year so I contacted doddl to discuss our options. We ended up switching our mortgage. All the staff were incredibly helpful throughout the entire process and explained our options so clearly. The process was so quick and their online portal was so easy to use.

I can’t recommend doddl enough, they’re brilliant at what they do.

Home buying news and insights

Costs to consider as part of the Home Buying process

For most people saving the 10% of purchase price required for home purchase can be a challenge. If you are a first...

Mortgage Interest Rates in Ireland 2025 – What’s New?

Are you on the lookout for a new mortgage? It's always important to understand the different options and rates...

Can I get a mortgage while pregnant or on maternity leave?

Can you get a mortgage while pregnant or on maternity leave? If you are applying for a mortgage and are currently on,...

We’re the mortgage experts the media call on!