Mortgage FAQ

Whether it’s your first rung on the ladder or your longterm dream home, buying a new place is a complicated, time-consuming process. Our job is to simplify all that, so you’ve got more time to focus on the fun stuff.

About doddl

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

Who are doddl?

We offer more than just mortgage, we offer home insurance, life assurance, we have a home buying helper expert within our team to guide you through the home buying process and we offer a digital conveyancing legal partner to help you complete out on your purchase or switch.

We are a mortgage broker working with all major lenders and insurance providers in Ireland and are regulated by the Central Bank of Ireland.

We are a digital broker offering mortgage consultations at a time that suits you. We have a secure application portal, our Digital Mortgage Experience DMx Platform which is unique in the Irish market and available to doddl mortgage clients only. This platform allows you access to your mortgage account 24/7, provides full transparency as to your stage in the process all supported by your dedicated mortgage advisor who you can call or message through the portal.

We work on behalf of our clients to secure the best mortgage and terms for their individual circumstances and we are your mortgage partner throughout your entire mortgage lifecycle. We will advise you when you can save money by switching to a better rate and are always on hand to answer any queries you may have.

Read more about us here.

Do doddl lend money?

No doddl is not a bank or money lender. doddl is a mortgage and insurance broker working with Irelands largest providers including lenders who do not deal with clients directly, who only work with select brokers such as doddl.

Which banks do doddl work with?

We work with all major Irish lenders. Bank of Ireland, Avant Money, AIB (through Haven their broker channel), Permanent TSB, Finance Ireland and ICS. So, there’s no need for you to apply to each lender separately, we can do all the research and make applications to your chosen lender with you.

We will apply to lenders on your behalf. When you come to doddl you have access to all major lenders, cashback offers, lowest market rates. Our role is to find the mortgage product that best suits your needs.

How does doddl make money?

Our service is free to you, our customer, we get paid by the lender that you choose to take your mortgage with.

We get paid the same fee regardless of the lender or product you select, which ensures there’s no lender or product bias. Also, you’ll get the same rates via doddl, as you would by going to the lender directly. Our role is to help you identify the best mortgage for you and to do the hard work on your behalf in securing approval and dealing with the bank.

You will never be charged anything by doddl.

How does doddl use my data?

We only use the data for the purpose that it was collected for and carefully protect your data from loss, misuse, unauthorised access or disclosure, alteration or destruction.

This is explained in our Privacy Policy.

New mortgages

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

How can doddl help?

At doddl we are a team of over 45 mortgage specialists who work in mortgages every day. If you feel overwhelmed and dont know where to start then speak to one of our advisors.

We deal with thousands of mortgages every year both for purchasers and switchers. We work with all major banks and providers in Ireland and offer lowest market rates, Green rates, cashback offers and all flexible terms.

You dont need to know everything about mortgages because we do!

Our role is to work with you to secure the best mortgage for your personal circumstances. We will look to establish your requirements and needs and look to find the mortgage that best suits you.

Whether you are in research mode planning to make an application in the near future or are ready to progress to get Approval in Principle in place so that you can start house hunting we are here to help.

We work with home purchasers and mortgage switchers. Our aim is to be your mortgage partner throughout the life of your mortgage, working with you to review your mortgage at regular intervals to ensure you do not pay more than you need to.

We dont just do mortgages, we offer life cover, home insurance, a digital conveyancing legal partner, a home buying helper. Our DMx Mortgage Application portal allows you to engage with us anytime, anywhere and your stage in the process is transparent 24/7 via your secure account on our DMx platform.

Our service is always free to you our valued customer, you will never be charged a fee by doddl. We get paid by the provider you choose to take your mortgage or insurance with and really important to note the payment we receive is the same regardless of the mortgage lender.

Our team are normal people who will work to answer any of your questions and will break down the complex mortgage process and support you throughout. Get in touch, we would be delighted to help!

Do I need to pay doddl?

Our service is 100% free of charge to our customers.

Like all brokers, our fee is paid by the lender or insurance provider you choose to take your mortgage or insurance product with.

We receive the same fee regardless of the lender you choose to take your mortgage with and you will get access to lowest market rates, cashback offers, Green rates and flexible terms by taking your mortgage with doddl.

We work with all major lenders and insurance providers in Ireland.

Let us take the stress out of securing your mortgage, its what we do.

What is a mortgage broker?

A mortgage broker is a person or company who arranges your mortgage with a mortgage lender.

Brokers offer access to multiple lenders and at doddl we offer mortgages for all major lenders and insurance from all major insurance providers.

We are essentially a distribution channel for the banks so instead of you having to go to each bank individually to understand what they offer, we do that hard work for you.

Some brokers charge a fee, at doddl we do not.

As a broker we are regulated by the Central Bank of Ireland and our role is to work on your behalf to find the best mortgage to suit your needs.

If you go to one bank they will only offer you their rates and terms, if you go to doddl we can offer you the rates and terms for all lenders and providers we work with and can advise on which will best suit your needs.

Our aim is to be your mortgage partner throughout your mortgage lifecycle. Always here to help and offer support.

How much can I borrow?

When banks assess a mortgage application they look at three key pillars for lending -

1. Income - banks can allow you to borrow up to 4 times 'allowable income' if you are a first time buyer or 3.5 times if you are a second time buyer.

Allowable income is taxable income including gross annual basic income, a portion of variable income once proven.

Exceptions are available to go above this 3.5 and 4 times limit and lenders grant exceptions on a case by case basis.

We have full access to all lenders credit policy at doddl so can advice exactly how much each will lend to you.

2. Loan to Value

Irish residents qualify for a loan to value of up to 90% for Irish properties under Central Bank lending rules.

As such you need to have 10% of the proposed purchase price as deposit (plus additional funds for transaction costs such as stamp duty and legal fees).

3. Clear evidence of repayment capacity

Every mortgage lender will need to see that you can afford the proposed mortgage repayment. The banks will take your proposed mortgage rate and 'stress test' the current interest rate at 2% above the actual rate (to allow for rate increases) and they will want to see that you have proven in the last six months that you can afford the proposed stress tested repayments. This can be demonstrated by way of rent currently paid, savings or loans discontinuing.

Your mortgage advisor at doddl will work through each of the above areas of your application with you and ensure we present the best possible case to the bank for approval. Its what we do!

Check out our mortgage calculators to find out how much you can borrow.

Who offers the best mortgage?

If there was one 'best' lender then our job would be very easy!

There are a wide range of mortgages available on the Irish market and rates vary significantly. When we work with a client we will be looking to identify their needs with regard to mortgage level, rate, term, any flexible benefits such as overpayment that may be required plus cashback options.

Every mortgage application is different and what we look to do is to find the best mortgage for our customers circumstances.

Circumstances can change over time and so can rates so we would work with our customers on multiple occasions to review their interest rates and financial position and switch mortgage as needed.

What is a mortgage?

A mortgage is a loan given by the bank to a customer or joint customers to buy a property.

The loan is secured on the value of the property.

Repayments are paid monthly on a mortgage and level of repayment depends on the mortgage balance, interest rate and mortgage term.

Switching your mortgage

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

What is mortgage switching?

Mortgage switching is moving your mortgage from one bank to another generally to save on interest.

Your mortgage repayment is made up of interest and capital and the lower you can keep your interest throughout the term of your mortgage the less interest you repay.

Interest is paid on every mortgage but our goal at doddl is to reduce the interest you repay. Interest adds no value to your mortgage and if you pay more than you should it is a needless cost to you.

By switching your mortgage and reducing your interest rate, you can reduce your monthly payments or your mortgage term.

This can result in savings of tens of thousands over the life of your mortgage.

For most households, their mortgage is their largest financial commitment, so it is hugely important to understand what mortgage rate you are repaying and to see if you can reduce this outgoing.

At doddl this is what we are here to help with. As your circumstances change, so can your mortgage and we’re here to do that work for you.

Mortgage switching is much easier than home purchase, when you purchased your home you had to deal with bidding, buying and moving home.

There is paperwork involved but our DMx application platform and team help to make the process easier and the savings that you can make far outweigh the time it takes to pull together the documents. Once we have all to hand we can push everything forward for you to complete the switch.

If you dont know whether it makes sense for you to switch then just ask our team, we will do the number crunching for you.

You will only switch if it makes sense to do so but the important point is to check your rate and speak to our team and if you can save by switching then do it!

How do I know if I should switch?

We can help - our team can calculate if you can save by switching and we can complete the switch with you.

Check out our simple switching calculator.

Rates have increased since 2022 and as such it is so important to secure the best rate you can achieve.

You may want to go variable, fix for a short or medium term or fix for whole of mortgage term, we can advise and help you secure the best rate for you.

Get Started on our website today, provide some initial information re your current mortgage and our term will come back to you to tell you if you can save by switching and advise you on all options available. And remember our advice is always free to you.

If you dont know where to start, get in touch, we have over 45 mortgage specialists at doddl who can help.

How much could I save by switching?

At doddl we will review your current rate and terms and let you know if you can save by switching.

As a starting point our Switching Calculator will let you know if you can save by switching and our team can give you all the options available to you. We just need some initial information and we can do the research and hard work for you.

It’s free and easy to check and literally takes about 30 seconds to fill in.

Then it’s important to start the process so that one of our advisors can provide you with more information and next steps to realise your interest savings.

At doddl we are the mortgage switching experts in the Irish market. Our advisors, technology and process make it easier for you to understand if it makes sense to switch and we will help you complete the switch.

Check out the News section of our site for our quarterly Mortgage Switching Index with the Irish Independent. This shows the huge savings that can be made by switching with doddl.

How much will switching cost?

At doddl we do not charge any fee for our service.

You will only every switch if you have a financial benefit in doing so and if there is you will progress to application and completion.

Through the switching process you will be required to engage a solicitor to complete a certification of title, this process is not the same or as extensive as a conveyancing process at time of purchase and as such there is lower fee. We have a panel solicitor offering a flat fee and excellent service to our customer.

You will also have a valuation fee of c. €185 and your valuation will only be required once you have approval and have decided to progress.

So again no cost unless you decide to progress to complete out on the switch and you will only do that if you will save by switching.

Many of the lenders have ‘Switcher Packages’ which covers the legal and valuation fees. The lowest Switching Package is €2,000 other lenders offer 3% of the mortgage back in cash to switcher customers. Ask our team about the various switcher packages available.

Our expert advisors will outline the saving options by lender and will also set out the switcher packages on offer from each lender.

How long does switching take?

On average the process takes about 6 weeks but most of this work is behind the scenes and we’ll take care of that. Keeping you up to date along the way.

What documents are needed?

To start with, all we need is a few straightforward pieces of information that can be filled in on our DMx portal. This will help us to get a better understanding of your circumstances, so we can provide you with all the options that we feel meet your needs.

Once you progress to application we will need documents to verify your identity, income and bank statements. This will all be clearly set out to you on your account on our application platform and by your advisor.

At doddl we have built an Application Platform, our DMx platform which allows you to complete a digital application form, verify your identity and upload documents to our account on our portal 24/7. We have a full messaging facility direct to your advisor and lots of helpful information for each stage of the process.

Our technology and advisors will streamline the mortgage documentation and application process for you.

Mortgage protection

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

What is mortgage protection insurance?

Mortgage Protection is a type of life cover insurance that is designed to clear a mortgage in the event of the policy holders’ death.

The policy is designed to clear the outstanding amount of your mortgage.

The amount insured decreases over the term of the policy.

The monthly premium of the policy remains the same for the duration of the plan (unless indexation is selected).

All mortgage applicants must have life cover in place before their mortgage is drawn down.

Mortgage protection is the cheapest form of life cover and is the minimum amount your mortgage lender will require.

At doddl we work with all major insurers and will price match to lowest market rate plus apply the maximum discounts available to ensure you get the lowest premium we can achieve.

Our Advisors will ensure you understand when and what type of cover you need and what suits you best, so dont worry we will explain all and work out the best policy for your needs and budget.

How much does mortgage protection cost?

Mortgage protection is the least expensive form of life cover.

How much you will pay monthly i.e. the monthly premium will depend on sum insured (level of cover), term of the policy (usually same as mortgage), your age, smoker status and medical history.

Premiums start from €10 per month but can vary significantly. Check out our instant quote calculator on our life assurance page.

It is important to have cover in place but equally important to know that you can afford this for the long term and know that it is in place if you need to make a claim.

At doddl we can help you tailor a package that is personal to your budget and your needs and don’t forget, our service is free!

Complete Get quotes section for the best policy for you.

If you have any queries email us at [email protected] or call us on 01 6624600.

What is life cover?

Life cover is a type of insurance policy that pays out in the event of the death of the policy holder.

What are the most common types of cover when taking out a mortgage?

The most common types of cover to provider protection are -

- Life cover - a Mortgage Protection or Level Term cover policy.

- Specified Illness cover - paying a lump sum on diagnosis of a specified illness.

- Income Protection - provides a replacement income in the event of illness or disability.

All of the above cover is important but all has a cost, our advisors work with you to establish what cover best meets your needs and protects you but also what you can afford now and in the long term.

Our aim is to meet your needs within your budget.

Do I need cover in place to draw down a mortgage?

All mortgage providers require a life policy to be in place before allowing you to draw down a mortgage on a home loan. The life policy will be assigned to the mortgage lender while the mortgage is in place.

What is a 'level term' policy?

Level term cover is a type of policy whereby the amount insured stays the same for the duration of the term.

In the event of death, the policy will pay out the sum insured, if the policy is assigned to a mortgage lender the mortgage will be repaid from the proceeds of the policy and any further benefit will pay to the second person on the policy. If the life policy is in one person’s name, the remaining benefit will pay to their estate.

This is generally a better form of protection that a decreasing term mortgage protection policy.

What is a 'conversion option'?

A Convertible option allows you to ‘convert the policy’ and extend the term of your policy, subject to terms but without medical assessment at time of conversion.

This is an add on to life cover policies and your advisor will set out the benefits associated with this option.

Are there any other types of protection I should consider?

Life cover will pay out in the event of the policy holder’s death and as such is used to clear an outstanding mortgage commitment or provide for family depending on the policy in place.

However there are other 'living benefit' policies that you can take out to further protect yourself and your family.

These can provide additional protection if you are unable to pay your mortgage or bills due to an accident or illness.

The most popular policies are Income Protection and Specified Illness cover.

We can provide quotes for these policies, all priced to lowest market rate, or can discuss the benefits of such policies so you understand if they are a priority for you now or perhaps something to consider for the future.

What is income protection?

Income protection is a policy that will pay out a regular payment that replaces part of your lost income if you cannot work due to a medium to long-term illness or disability.

This is a taxable income paid in addition to any social welfare entitlement and you can claim tax relief on the premium.

This type of cover is particularly important for self employed applicants. Premium is tax deductible.

Do I need income protection even if my employer pays me when I'm sick?

It’s important to be aware of your employer benefits before considering any policy to ensure the cover you choose is appropriate for you.

If your employer has a scheme that will pay you long term if you are out sick, then you will not need to consider an income protection policy.

If your employer pays you for a period of time e.g., 3/6/12 months then you can consider an Income Protection policy that would start to pay you when your employer income ceases, if you cannot return to work.

You should enquire as to any employee benefit available so that you can understand any additional needs you may have.

What is specified illness cover?

Specified Illness cover is a tax-free lump sum that is paid out on diagnosis of a specified illness as defined in the terms and conditions of your policy.

This policy is designed to help you pay towards the cost of being sick. Your health insurance/public system covers the hospital costs but there may be other costs which can increase the financial burden when you’re sick. These may include time off, additional childcare, cost of travel to and from hospital, consultant fees not covered by health insurance, accommodation, parking, outpatient treatments/therapies.

A Specified Illness benefit will provide you with financial breathing space to allow you to concentrate on getting better and not worry about your finances.

Digital Mortgage Experience (DMx)

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

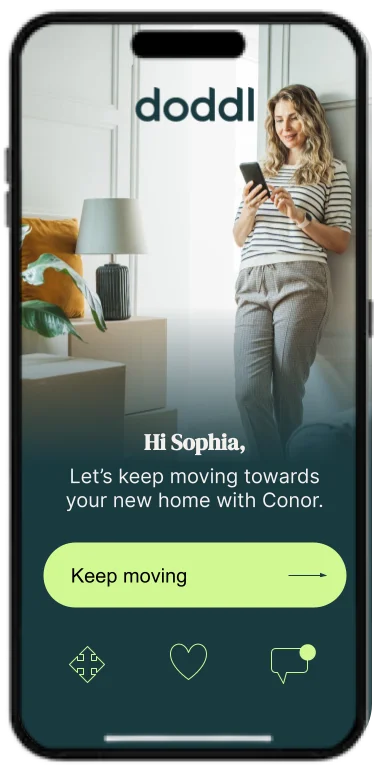

What is the doddl DMx platform?

At doddl we have been working with mortgage applicants for over a decade. We realise that mortgages are complex and clunky.

We listened to our customers who were very clear that their priorities during the mortgage application process were to be able to get expert advice, have a dedicated advisor, access to all the best rates and products on the market and to be able to easily understand what option best suited them. They wanted to be able to complete and sign a digital application form, to be able to upload documents securely and most importantly have a transparent view of where they are in the process 24/7.

We listened! And we created what we believe is a best in class Digital Mortgage Experience, our DMx platform.

You will have 24/7 access to your mortgage account, you will know exactly where you are in the process, you will be able to message and call your advisor with any queries and our portal will also provide you with access to quotes and content re life cover, home insurance and a digital conveyancing platform.

You will also have access to our free Home Buying Helper service via your account on our DMx portal once you are mortgage approved.

This is a unique platform available exclusively to doddl mortgage applicants. We believe it will make your mortgage and homebuying journey a better experience.

How do I get started?

It’s easy to get started. Whether purchasing or switching, just head on over to our Get started page and walk through a few simple steps.

Once you complete these steps you will be given a link to access you account on our portal. This will then set out all documents required to complete a mortgage application, you will be advised of the doddl advisor who has been assigned to support you through the process and you can start to work through your mortgage application on our secure application plaform, our Digital Mortgage Experience portal or DMx.

You will have access to your account 24/7, you can message or call your advisor, you can see what stage you are in the process and whats next, all transparent and all with the help and support of our team.

What happens if I choose to progress?

We’ll let you know which documents we’ll need. We’ll also send you a link to our secure customer portal - the doddl DMx.

This allows you to upload documents and complete your mortgage application easily online. You’ll always have access to your account and will have visibility of your application at every stage. Your dedicated advisor will guide you through as your application progresses and be there to answer any questions you have.

Why choose doddl?

We’ll not only act as your mortgage partner but we’ll be there to provide friendly, impartial advice to ensure you glide through the process.

We’re here to answer any queries you have and will review rates at regular intervals to ensure you never pay more than you need to - all in one simple to navigate Digital Mortgage Experience.

We understand that most people have never done this before, but we’ll be there for you, every step of the way, acting in your best interests at all times.