Mortgage protection insurance

Tailored to you.

Protect what matters most to you. Our expert advisors will discuss your situation and find a policy that suits your mortgage protection needs and your budget.

We work with all insurers

So we can price match to the lowest available mortgage protection rate on the market.

Life Assurance quotes

Provide a few details and we’ll email you your personalised mortgage protection quote.

Dedicated advisor

Your dedicated advisor is on hand to answer mortgage protection questions and get everything set up for you.

Get mortgage protection, the easy way

We’ve got you covered, at no cost to you.

1.

The three minute fill

Simply fill in a few straightforward details on our ‘Quote Form‘ above and we’ll take it from there.

2.

Your expert will review your needs, for free!

Our experts will look at your needs and tailor a Mortgage Protection policy that protects what matters to you.

3.

From quote to cover

We’ll guide you through everything, so you can relax and know you’re protected.

4. (optional)

Tell a friend how you took the stress out of getting covered

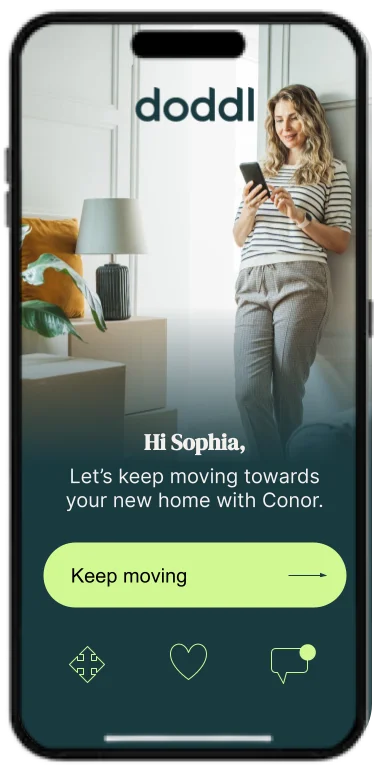

We’re on a mission to make mortgages and insurance way easier. Give the gift of doddl.

Happy insurance customers across Ireland

4.8 out of 5 Google Rating

We’ve helped thousands of Irish mortgage customers sort their mortgage protection & home insurance.

They were extremely quick to get back on any questions I had and were so helpful. The Doddl platform is also really well designed so it makes it easier to see what documents are needed and keeps everything organised. It was great to be able to sort our life insurance through the same group and our solicitors with their sister company Beam too. It was so efficient. Thanks very much to everyone who helped us get our mortgage over the line. I’ll be recommending you to friends and family.

Our biggest worry at the beginning of buying our house was not picking the right broker, thankfully we were told about doddl and everything was true. The people we worked with throughout the process were all super proactive and responsive making the whole experience as smooth as popular.

The portal was also a great value add! I will be referring my friends and family to use doddl in the future!

Home Insurance FAQ

Questions are for answers. Here’s everything you need to know about mortgage protection, home, and life cover.

Top

Your content goes here. Edit or remove this text inline or in the module Content settings. You can also style every aspect of this content in the module Design settings and even apply custom CSS to this text in the module Advanced settings.

What is mortgage protection insurance?

Mortgage Protection is a type of life cover insurance that is designed to clear a mortgage in the event of the policy holders’ death.

The policy is designed to clear the outstanding amount of your mortgage.

The amount insured decreases over the term of the policy.

The monthly premium of the policy remains the same for the duration of the plan (unless indexation is selected).

All mortgage applicants must have life cover in place before their mortgage is drawn down.

Mortgage protection is the cheapest form of life cover and is the minimum amount your mortgage lender will require.

At doddl we work with all major insurers and will price match to lowest market rate plus apply the maximum discounts available to ensure you get the lowest premium we can achieve.

Our Advisors will ensure you understand when and what type of cover you need and what suits you best, so dont worry we will explain all and work out the best policy for your needs and budget.

How much does mortgage protection cost?

Mortgage protection is the least expensive form of life cover.

How much you will pay monthly i.e. the monthly premium will depend on sum insured (level of cover), term of the policy (usually same as mortgage), your age, smoker status and medical history.

Premiums start from €10 per month but can vary significantly. Check out our instant quote calculator on our life assurance page.

It is important to have cover in place but equally important to know that you can afford this for the long term and know that it is in place if you need to make a claim.

At doddl we can help you tailor a package that is personal to your budget and your needs and don’t forget, our service is free!

Complete Get quotes section for the best policy for you.

If you have any queries email us at [email protected] or call us on 01 6624600.

What is life cover?

Life cover is a type of insurance policy that pays out in the event of the death of the policy holder.

What are the most common types of cover when taking out a mortgage?

The most common types of cover to provider protection are -

- Life cover - a Mortgage Protection or Level Term cover policy.

- Specified Illness cover - paying a lump sum on diagnosis of a specified illness.

- Income Protection - provides a replacement income in the event of illness or disability.

All of the above cover is important but all has a cost, our advisors work with you to establish what cover best meets your needs and protects you but also what you can afford now and in the long term.

Our aim is to meet your needs within your budget.

Do I need cover in place to draw down a mortgage?

All mortgage providers require a life policy to be in place before allowing you to draw down a mortgage on a home loan. The life policy will be assigned to the mortgage lender while the mortgage is in place.

What is a 'level term' policy?

Level term cover is a type of policy whereby the amount insured stays the same for the duration of the term.

In the event of death, the policy will pay out the sum insured, if the policy is assigned to a mortgage lender the mortgage will be repaid from the proceeds of the policy and any further benefit will pay to the second person on the policy. If the life policy is in one person’s name, the remaining benefit will pay to their estate.

This is generally a better form of protection that a decreasing term mortgage protection policy.

What is a 'conversion option'?

A Convertible option allows you to ‘convert the policy’ and extend the term of your policy, subject to terms but without medical assessment at time of conversion.

This is an add on to life cover policies and your advisor will set out the benefits associated with this option.

Are there any other types of protection I should consider?

Life cover will pay out in the event of the policy holder’s death and as such is used to clear an outstanding mortgage commitment or provide for family depending on the policy in place.

However there are other 'living benefit' policies that you can take out to further protect yourself and your family.

These can provide additional protection if you are unable to pay your mortgage or bills due to an accident or illness.

The most popular policies are Income Protection and Specified Illness cover.

We can provide quotes for these policies, all priced to lowest market rate, or can discuss the benefits of such policies so you understand if they are a priority for you now or perhaps something to consider for the future.

What is income protection?

Income protection is a policy that will pay out a regular payment that replaces part of your lost income if you cannot work due to a medium to long-term illness or disability.

This is a taxable income paid in addition to any social welfare entitlement and you can claim tax relief on the premium.

This type of cover is particularly important for self employed applicants. Premium is tax deductible.

Do I need income protection even if my employer pays me when I'm sick?

It’s important to be aware of your employer benefits before considering any policy to ensure the cover you choose is appropriate for you.

If your employer has a scheme that will pay you long term if you are out sick, then you will not need to consider an income protection policy.

If your employer pays you for a period of time e.g., 3/6/12 months then you can consider an Income Protection policy that would start to pay you when your employer income ceases, if you cannot return to work.

You should enquire as to any employee benefit available so that you can understand any additional needs you may have.

What is specified illness cover?

Specified Illness cover is a tax-free lump sum that is paid out on diagnosis of a specified illness as defined in the terms and conditions of your policy.

This policy is designed to help you pay towards the cost of being sick. Your health insurance/public system covers the hospital costs but there may be other costs which can increase the financial burden when you’re sick. These may include time off, additional childcare, cost of travel to and from hospital, consultant fees not covered by health insurance, accommodation, parking, outpatient treatments/therapies.

A Specified Illness benefit will provide you with financial breathing space to allow you to concentrate on getting better and not worry about your finances.

Mortgage news and insights

Three ways to boost your chances of becoming a homeowner in 2026

Buying a home in 2026 – three ways to boost your chances of becoming a homeowner in 2026 Demand from first time buyers...

Doddl in the News – Your Mortgage Updates for 2026!

🗞️Doddl in the News x5 this week! We are the experts the media call upon. We had lots to talk about this week,...

Your Guide to Mortgages and Homebuying in 2026

The Irish mortgage market is constantly changing. Over the last twelve months we have seen rate cuts, new products...

We’re the experts the media call on!