Understanding your purchase power is something that we can really help with, here’s how –

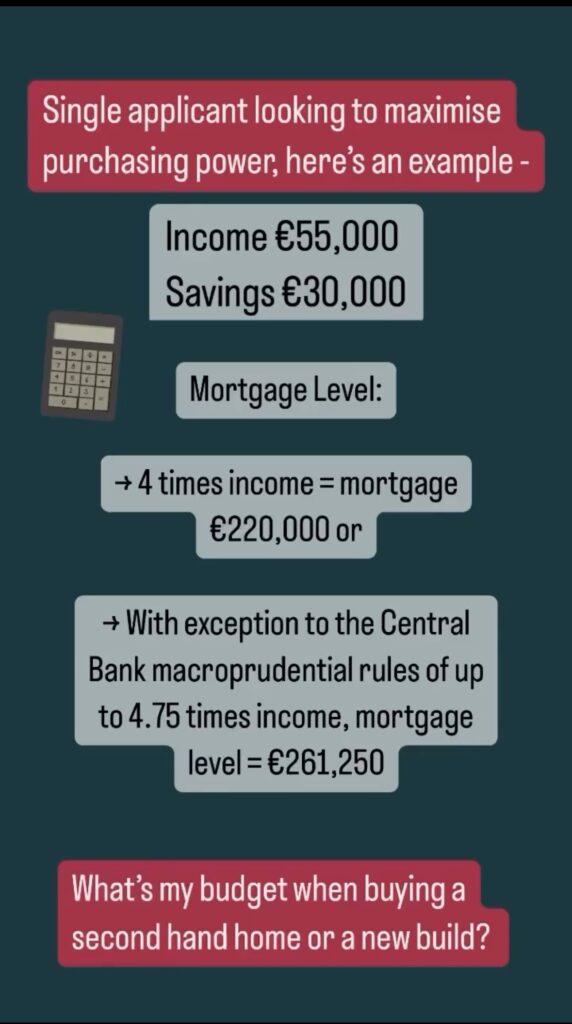

We are all too well aware of the issues in the property market right now, the lack of affordability and even availability of homes, continued house price inflation all mean that in general our clients come to us to understand what their maximum budget is and what their options are. No one wants to borrow more than they have to and the objective is always to keep mortgage level and interest as low as possible. The reality however is that many clients look to borrow at maximum level and also exceptions to the standard Central Bank rule of 4 times lending are in demand.

As a broker we have access to all major lenders and important to note not all lenders offer the same amount, lenders all have different underwriting policy in particular if you are someone who has variable income such as bonus, commission, overtime etc.

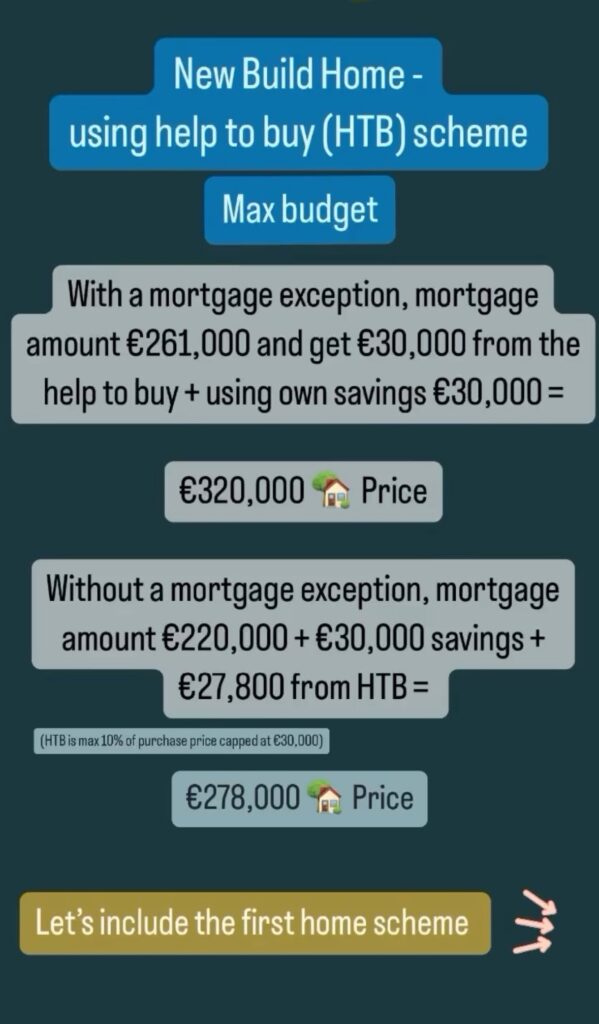

How the help to buy and first home scheme can help

Understanding how much you can borrow is one element of the advice that we offer but we also want our clients to be armed with as much information as to the supports that are available to assist with purchase. Many of the Government supports are for first time buyers purchasing new build homes. These can come in the form of the help to buy, supporting deposit or the first home scheme which is designed to bridge the gap between what you can borrow plus deposit and the purchase price of a home.

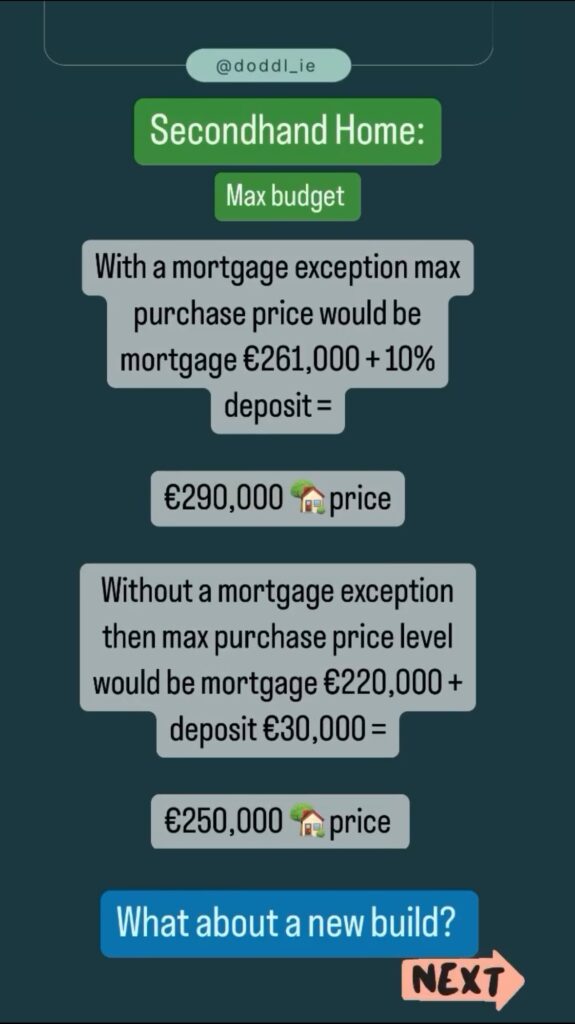

I want to buy a second hand home, with no schemes available what do I need to know

There are more second hand homes mortgaged each year than new build homes so it is important to understand your budget when it comes to maximum purchase price for second hand homes. Many second hand homes that come to market require work and it is important to know that you can finance works as part of your overall mortgage, provided the proposed works add requisite value and your overall loan to value does not exceed 90%. Our advisors work with clients to help understand what’s possible and cashflow considerations when financing works to a home.

Below are some examples of how we can help individualise your options by taking income and deposit and looking at budget when looking at second hand homes and new build homes.

If we can help you figure out your options check with your doddl advisor or new to our service then get started by contacting our team, its what we do! -> Start Here

With the same income and deposit what do options purchasing a new build home look like?

Here’s another example – a single applicant and options open –