Greening your home: Is it worth it?

As part of the Governments Climate Action Policy, the National Residential Retrofit Plan aims to achieve the equivalent of 500,000 homes retrofitted to a Building Energy Rating of B2 by end-2030.

To support this plan there are grants available to improve the energy efficiency of properties located in Ireland and built before 2011. The Sustainable Energy Authority of Ireland (SEAI) administer these grants which include attic and wall insulation, solar PV panels, Heat pump systems etc.

The Grants while a welcome boost will not cover the full cost of financings home improvements meaning many homeowners will need to borrow to make their home more energy efficient.

Improving the energy efficiency of our homes reduces the running cost, may lead to a lower mortgage rate and also increases the value of a home as higher energy rated homes command a premium in the current market.

How can I finance Green home improvements?

Options with regard to financings Green home improvements are in general, unsecured personal loans or releasing equity out of your home to carry out works.

What is the Home Energy Upgrade Loan Scheme?

Reduced cost loans are offered under the Home Energy Upgrade Loan Scheme which can be used where works are being grant-aided by the SEAI.

Loans to eligible applicants must be used for the purposes of upgrading the energy efficiency and decarbonisation of a qualifying residential property and an amount from €5,000 to €75,000 can be borrowed.

Reduced rates starting from 3% APR are available with loan terms of 1 to 10 years available.

Releasing equity out of your home for home improvements

For many homeowners that have seen mortgage repayments increase over the last three years taking on a separate loan facility to finance works may be a stretch too far on their monthly finances.

Releasing equity from your home to finance home improvements and lock in a Green rate while doing so is a popular alternative.

Latest figures from the Banking & Payments Federation show a surge in Mortgage Top Ups which have increased by 27pc year on year at an average value of €163,194.

Property price inflation remains strong with CSO figures to end June reflecting a Nationwide increase in home values of 9.6pc.

This increase in value means that there is an opportunity for homeowners to release equity out of their home to carry out home improvements to make their home more energy efficient and also more suitable for family living.

For anyone carrying out home improvements that will increase the building energy rating (BER) of their home to A or B seeking out a Green mortgage rate is essential.

BER certificates are valid for ten years and of all new homes built since 2017, 94pc were A rated.

Green mortgage rates are the lowest rates in the market right now starting from 3pc. Green rates are applicable when your BER is B or higher and applies to home purchasers or mortgage switchers.

Given the increasing numbers now eligible for Green rates it is an excellent opportunity to reduce mortgage repayments by seeking out these lowest market rates.

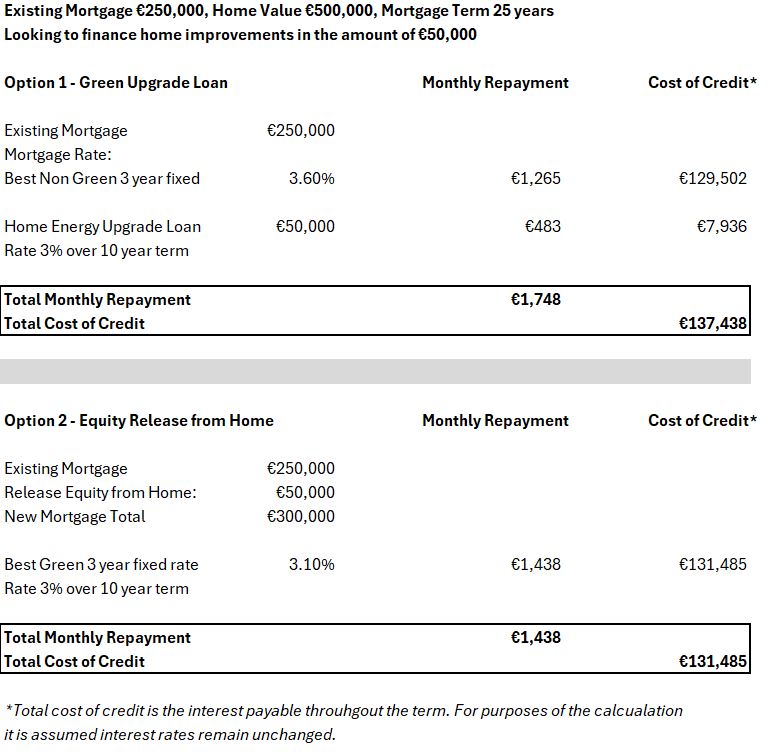

Let’s look at the numbers

From a cashflow perspective the most favourable way to finance the works is via an equity release on the mortgage. The Green rate on the overall mortgage combined with the longer mortgage term brings down the overall repayment, making it more affordable for households. The overall cost of credit is important to consider, a mortgage is a long term product by nature and in general the longer the term you repay the higher the cost of credit. Being eligible for a lower rate on the mortgage by virtue of a Green rate can positively impact the overall cost of credit, this is assuming Green rates remain at a low level.