What are Green Mortgage Rates?

Green mortgage rates are available from AIB Group – Haven Mortgages, EBS and AIB and also from Permanent TSB.

The lowest Green rate on the market is 3.2%.

Who is eligible for a Green rate Mortgage?

Green rates are available to eligible applicants who are –

- Purchasers

- Switchers

Green rates are available where your Building Energy Rating, your BER is B3 or above.

97% of all new homes build since 2015 were ‘A’ rated. BER certs are valid for 10 years.

If you are buying a new home, building a home or have a BER of B3 or higher on your current home then it is so important to seek out Green rates. Some Green rates come with cashback. Our team at doddl can advise you on rate available to you and can help you secure the lowest available rate.

What is the EcoSaver Mortgage from BOI?

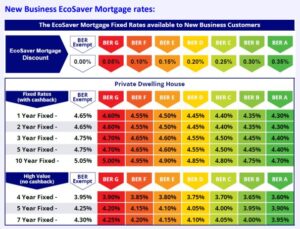

Following on from AIB Groups Green rate reduction announced yesterday, BOI have today announced the withdrawal of their existing Green rate products, which applied to mortgage holders with BER of B3 or higher, and the introduction of an ‘EcoSaver’ product.

This new product will apply discounts to BOI’s standard fixed rates based on BER rating from A right through to G.

The higher your BER, the higher the discount, with max discount for A rated homes 0.35% down to 0.05% for BER G and 0% discount for BER Exempt homes.

The higher your BER, the higher the discount, with max discount for A rated homes 0.35% down to 0.05% for BER G and 0% discount for BER Exempt homes.

There is no decrease in BOI’s fixed rates but the new EcoSaver product means an extension of discounts to BOI’s standard & high value mortgage rates which to date under ‘Green’ products were only available to those with BER higher than B3.

Now BER C or lower will also be eligible for a discount albeit a lower percentage discount.

This new Eco Saver product will go live from 18th April 2024. Rates as at 18th April 2024. BOI will continue to offer cashback offers of up to 3% on selected products.

A BER cert is required to avail of these products, BER certs must be in place for all homes currently sold in Ireland and are valid for 10 years from time of issue.

Green & Eco rates are the lowest rates available from BOI, AIB and PTSB all rewarding mortgage holders who have higher building energy ratings.

Across the market loan to value, mortgage value and building energy rating are factors that impact rates.

It is now even more important to seek out market based advice when taking out a mortgage or reviewing mortgage rates to ensure you get the optimal rate available.

Rates and what you may be eligible for can be confusing – please do contact our team for advice if we can be of help. Provide some information and we will be right back to you.

Hoping to purchase a home and need advice?

Have an existing mortgage and need to review your rate?